A single buyer trade credit insurance is designed to protect businesses from the risk of default from one of their customers. This coverage pays out a company a certain percentage of the amount owed by the customer in the event of nonpayment.

If you’re planning to protect your business against the risk of nonpayment from a specific, important customer, you may want to consider a single buyer trade credit insurance. But do you need to purchase this kind of insurance? Can it protect your business against losses and bad debt? When should you use it?

This blog will answer all these questions and more to help you make an informed decision.

Single Buyer Trade Credit Insurance Generally Covers the Risk of Nonpayment by One Customer

Single buyer insurance allows you to insure your most strategic customers, who account for a large percentage of your overall turnover. This policy offers customised solutions that protect your business against commercial and political risks.

It provides an extra layer of security against default, which can help improve supplier relationships and allow you to offer more attractive payment terms to their customers. Single buyer credit insurance also helps mitigate the risk of non-payment from customers, which can help protect your company from potential losses and secure cash flow.

When Should You Use a Single Buyer Trade Credit Insurance?

This insurance policy can be a good option when you want to protect your business against the risk of nonpayment from a particular buyer. It covers the risk of default if a single buyer fails to pay for goods or services provided.

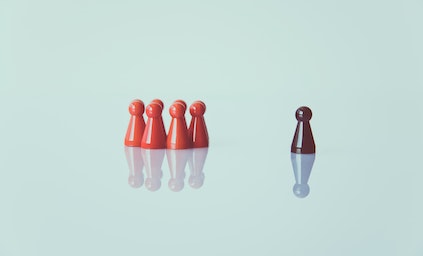

Single-buyer insurance is commonly used when dealing with a new customer, a buyer whose financial position is uncertain, or a customer with payment issues.

Do I Need a Single Buyer Trade Credit Insurance?

You may need this policy if you have a business that provides goods on credit terms and are worried about the risk of nonpayment by some of your customers. Sometimes, the decision to purchase a single buyer trade credit insurance will depend on the number and type of customers you have, their payment history, and how reliable they are.

If you are dealing with customers with poor creditworthiness, you may not qualify for this type of insurance. This is because most insurance companies may deny coverage to customers with a poor payment history. They may also impose restrictions on the amount of coverage or the type of trade credit transactions that can be insured. This policy can also be a bit expensive for small businesses.

On the other hand, if you are dealing with new customers or buyers with payment issues, you may consider purchasing single-buyer credit insurance. This is especially true if you have the financial ability to fund the policy.

This policy can reduce the risk of default from customers and help your business reduce and manage bad debt expenses. Other benefits of this policy include improved terms and conditions for supplies, streamlined collections processes, and increased access to working capital.

How Niche Trade Credit Can Help

At Niche Trade Credit, we supply a range of trade credit insurance policies, including single-buyer insurance. We can provide you with comprehensive single-buyer trade credit insurance that will protect your business from customer nonpayment. Get in touch with us for a free credit risk assessment and get started.

*DISCLAIMER: No person should rely on the contents of this publication without first obtaining advice from a qualified professional person. This publications sold on the terms and understanding that (1) the authors, consultants and editors are not responsible for the results of any actions taken on the basis of information in this publication, nor for any error in or omission from this publication; and (2) the publisher is not engaged in rendering legal, accounting, professional or other advice or services. The publisher, and the authors, consultants and editors, expressly disclaim all and any liability and responsibility to any person, whether a purchaser or reader of this publication or not, in respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance, whether wholly or partially, upon the whole or any part of the contents of this publication. Without limiting the generality of the above, no author, consultant or editor shall have any responsibility for any act or omission of any other author, consultant or editor.